Data tokens on this page

Financial Solutions

Financial Solutions

Avoiding Retirement Savings Mistakes

When it comes to funding your retirement, you have to watch your step. What seems reasonable today may not ultimately help you reach your goals. Following are eight important factors to consider as you formulate your retirement investment strategy.

Many investors have heard the stories of people on the road to achieving their retirement dreams becoming sidetracked by unforeseen developments. Circumstances arising from unexpected medical expenses, a downturn in the stock market, or a job loss forcing a re-evaluation of retirement options is an all-too-familiar tale. You may have experienced setbacks in your own retirement plans. Perhaps you have not contributed as much to your retirement savings as you had originally planned. Perhaps you have been too aggressive with your investments in an attempt to improve your portfolio’s performance and reach your goals sooner leading to losses. Everything changes.

Investors often fail to consider how important factors may become obstacles along their road to retirement. Some of the most important of these are inflation, a poorly-allocated portfolio, taxes, underestimated expenses, unrealistic investment performance expectations, length of retirement, mismanagement of tax-deferred assets, and health care expenses. To learn from the past, we must first look at these common mistakes and consider how best to avoid them.

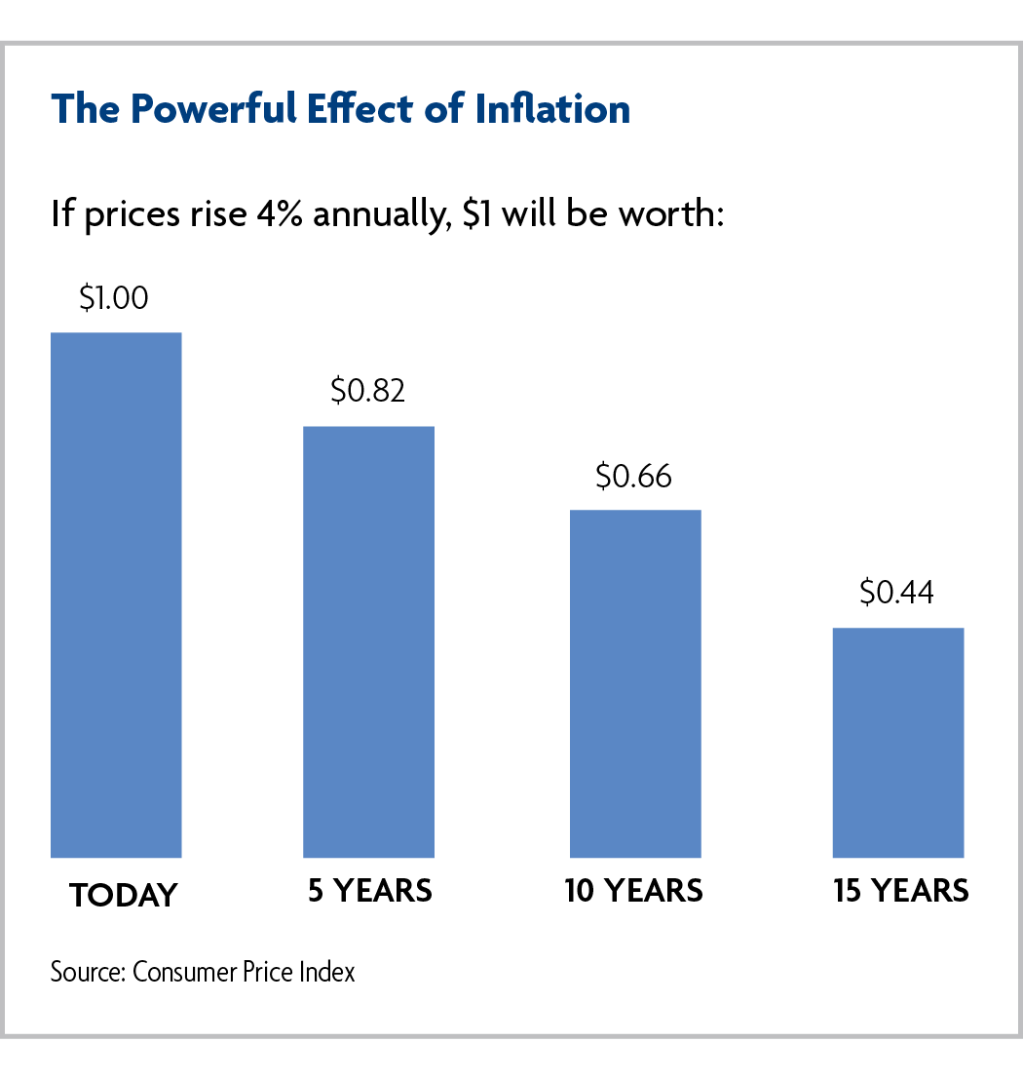

1: Forgetting About Inflation

Inflation can eat away at savings and threaten the ability of investors to maintain their lifestyle during retirement. Consider that during the next 20 to 30 years, cost of living will likely double—or even triple.

For example, a retirement fund of $1 million yielding 7% interest will generate $70,000 in annual income today. But in 20 years, at a conservative 4% inflation rate, more than double that income—$153,379—would be needed to maintain the same standard of living. Will your investment income keep up with the cost of living? Through a simple analysis, your financial professional can help you evaluate your ability to meet future needs considering your current expenses, inflation, taxes, and annual savings.

2: Not Having a Properly Allocated Portfolio

Asset allocation is the combination of asset classes (such as stocks, bonds, and cash alternatives) in a portfolio and their proportions to one another. Proper asset allocation can help take advantage of return potential while balancing risk.

Many investors’ retirement assets are not properly allocated based on their risk tolerance and stage in life. By not having an appropriate asset allocation, these individuals often expose their portfolios to unnecessary risk or invest too conservatively to realize their goals. Either way, they will likely fall short of reaching their retirement dreams.

For example, an investor in his or her early 30s, with many years until retirement, that has an asset allocation that is too conservative (e.g., investing only in bonds) will find it challenging to accumulate enough for the future, especially after taking the effects of taxes and inflation into account. On the other hand, a retiree in his or her late 60s that invests too aggressively (e.g., investing only in growth stocks) will struggle to meet income needs and will be exposed to more risk than necessary. It is important to remember that all investments carry some level of risk, including the potential loss of principal invested. Asset allocation does not guarantee against loss, rather it is a method used to help manage investment risk.

To find out whether your current investment mix is appropriate for your retirement goals, ask your financial professional for a free asset allocation analysis. This analysis will provide you a snapshot of your current portfolio and recommend how you can reposition your assets to better achieve your objectives or reduce your portfolio’s volatility.

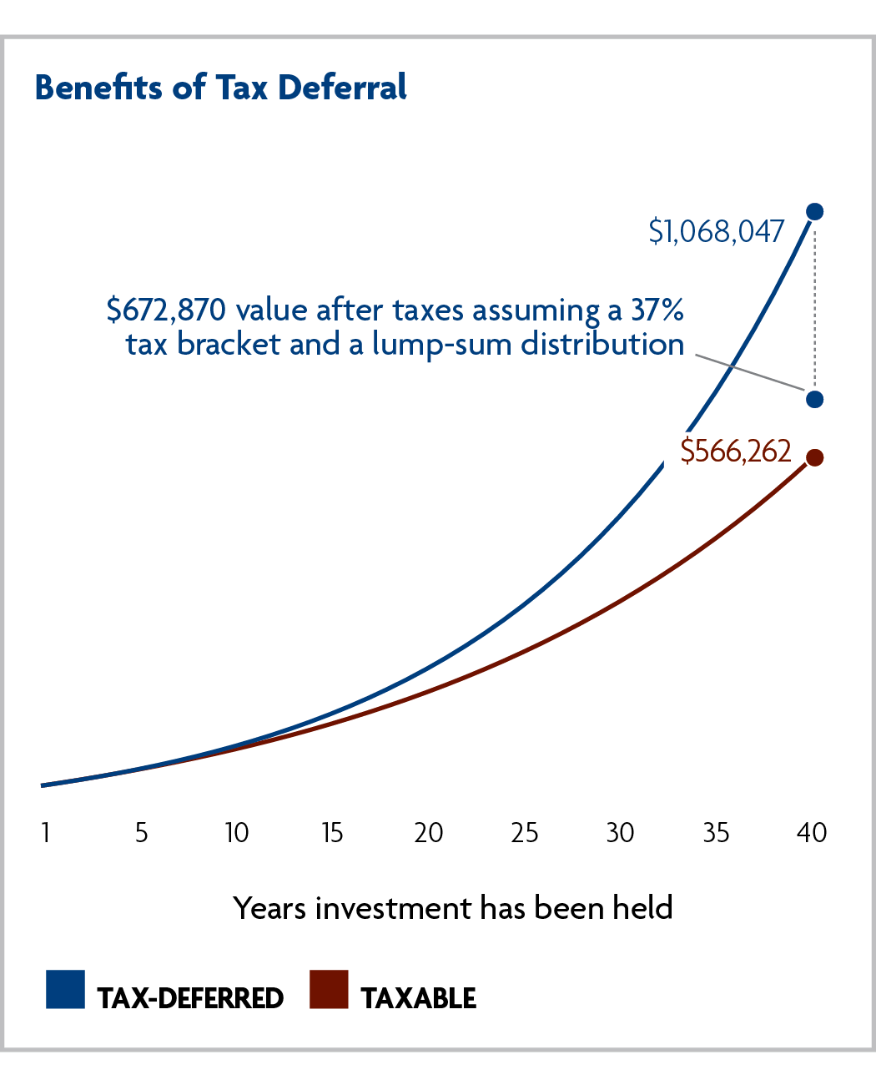

3: Underestimating Taxes

Like inflation, taxes can erode investment savings. Many people do not take full advantage of tax-deferred investment vehicles when saving for retirement. Money put into a tax-deferred investment—such as an IRA, 401(k) or another qualified retirement plan—will accumulate value free from tax until withdrawal at retirement. That means there will likely be money to generate retirement income for a longer time period. Any withdrawal before the age of 59½, however, may be subject to a 10% IRS penalty and will be fully taxable.

The hypothetical example on the right shows how much more can be saved for retirement in a tax-deferred investment versus a taxable investment. It illustrates a 7% rate of return on a $5,000 annual investment for 40 years. An investor in the 35% tax bracket would see that after 40 years of investing that amount annually, tax deferral would nearly double the account balance versus if the earnings were taxed each year. If the money is withdrawn all at once at the end of the period and the taxes paid at the 37% rate, the investor will still end up with over $100,000 more than he or she would have had with a taxable account.1

Lower tax rates on capital gains and dividends may result in more favorable returns on taxable investments, thereby reducing the difference in performance between the accounts shown. You should consider your personal investment horizon and income tax brackets, both current and anticipated, when making an investment decision, because these may further affect the comparison’s results. Fees and charges are not reflected in the illustration and would reduce the performance shown if they were.

4: Underestimating Spending During Retirement

Many investors think they will spend less in retirement than they do now. Often, however, they fail to take into account the possibility that they may want to take more vacations, make home improvements, or dine out more frequently once they retire. Beyond potential increases in discretionary spending, considerations must also be made for the possibility of facing unexpected healthcare, long-term care, and other expenses.

Will you have enough money to fund your retirement lifestyle? Your financial professional can help you estimate how much money you will need during retirement and show you strategies that could help you supplement your income.

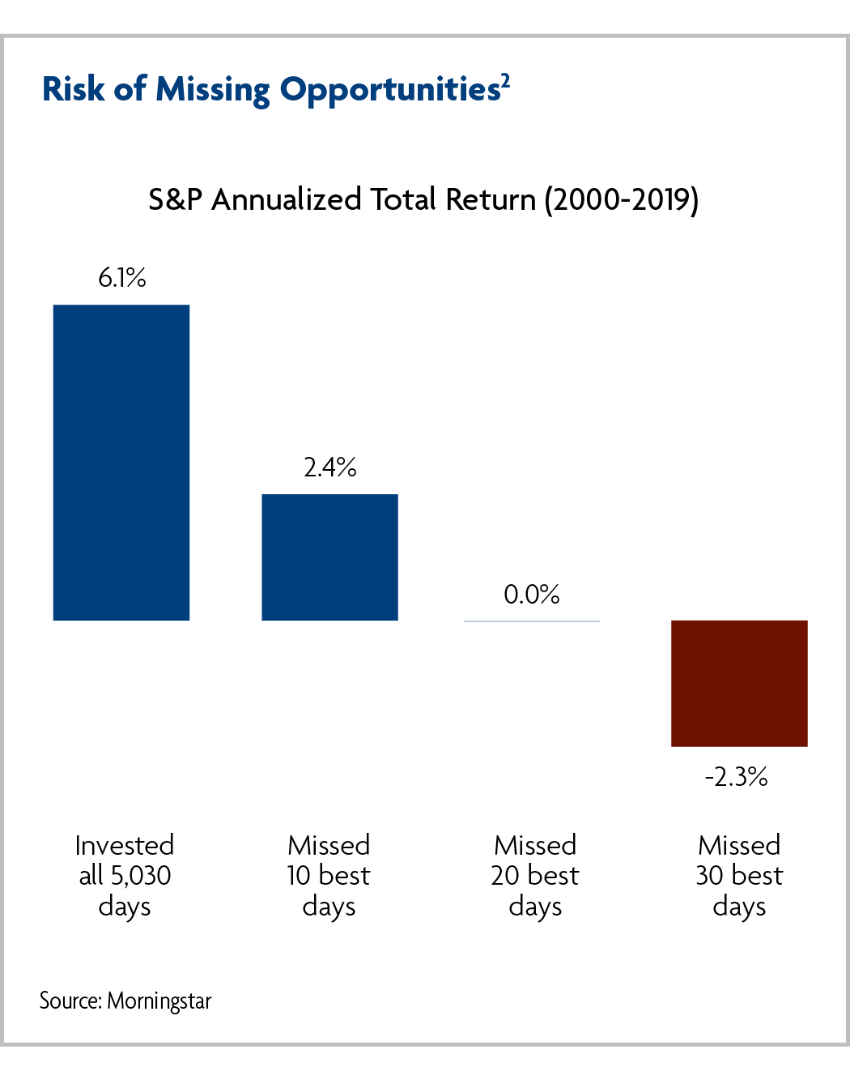

5: Having Unrealistic Investment Expectations

Some investors believe that when the market is down they should sit on the sidelines until it rallies. When the market is up, these investors often wait for a dip or a correction to buy at bargain rates. The market-timing tactics they attempt seldom work and in fact, have been shown to be fruitless in the long run. When building assets for retirement, investors need to stay focused on long-term goals, and prudent investors stay in the market.

The chart to the right shows the effect on the portfolio of an investor who invested in the S&P 500 on January 2, 2000, and missed the best 10, 20, or 30 market days of the ensuing 20-year trading period. Missing just a few of the market’s best days during that period resulted in significantly reduced returns. An investor that missed the 20 best days over the past 20 years would have generated no return and an investor that missed the best 30 days would have actually lost money. It is not market timing, but time in the market, that can bring about long-term success.

It is important to base your long-term investment strategy around realistic return expectations. Keep in mind, there will be “up” and “down” years. Successful investors, however, develop the discipline and patience to stay the course during market fluctuations.

6: Underestimating the Time Spent in Retirement

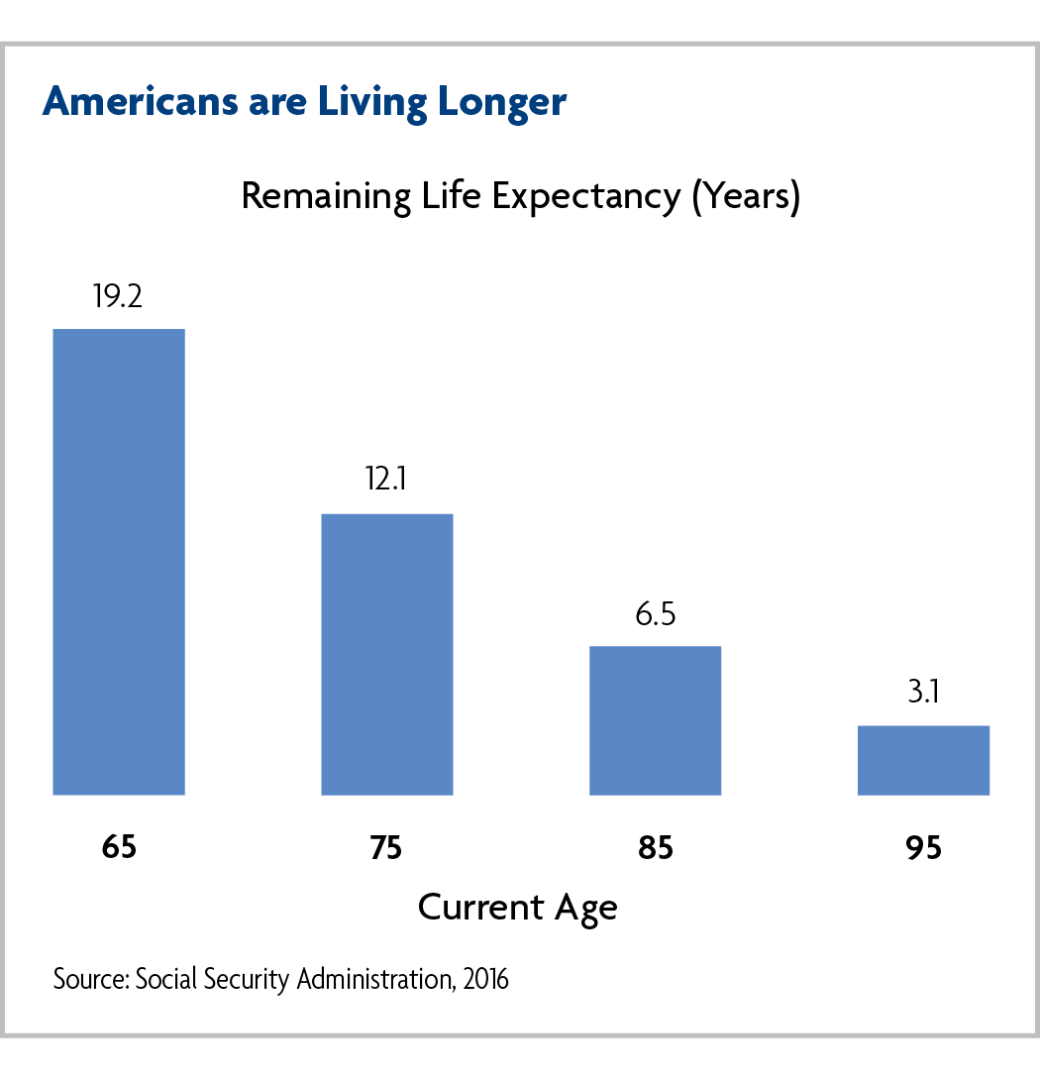

Due to better nutrition, quality medical care, and a growing health consciousness, life expectancies continue to rise in the United States. In fact, many Americans now live well into their 90s. For many, the time spent in retirement will exceed working years. That means retirees may live 20 to 30 years without receiving a paycheck. Will your assets last until you are in your 90s, or will you outlive your nest egg? Your financial professional can help you determine how long your retirement savings may last and help you develop a plan to make sure you continue to receive an income stream throughout retirement.

7: Mismanaging Tax-Deferred Assets

Some investors start taking withdrawals from their IRAs or retirement plans as soon as they reach age 59½. In fact, some people take withdrawals even earlier. However, this is often not the best approach. Remember—you could live 20 or 30 years in retirement, and taking withdrawals earlier than necessary will cause your nest egg to deplete faster.

Distributions are required to be taken from traditional IRAs and annuities once you reach age 70½. However, there are no mandatory distributions from Roth IRAs at any age. Consider withdrawing funds from taxable investments first. This will give your tax-deferred vehicles more time to work for you.

8: Failing to Plan for Unexpected Health Care Expenses

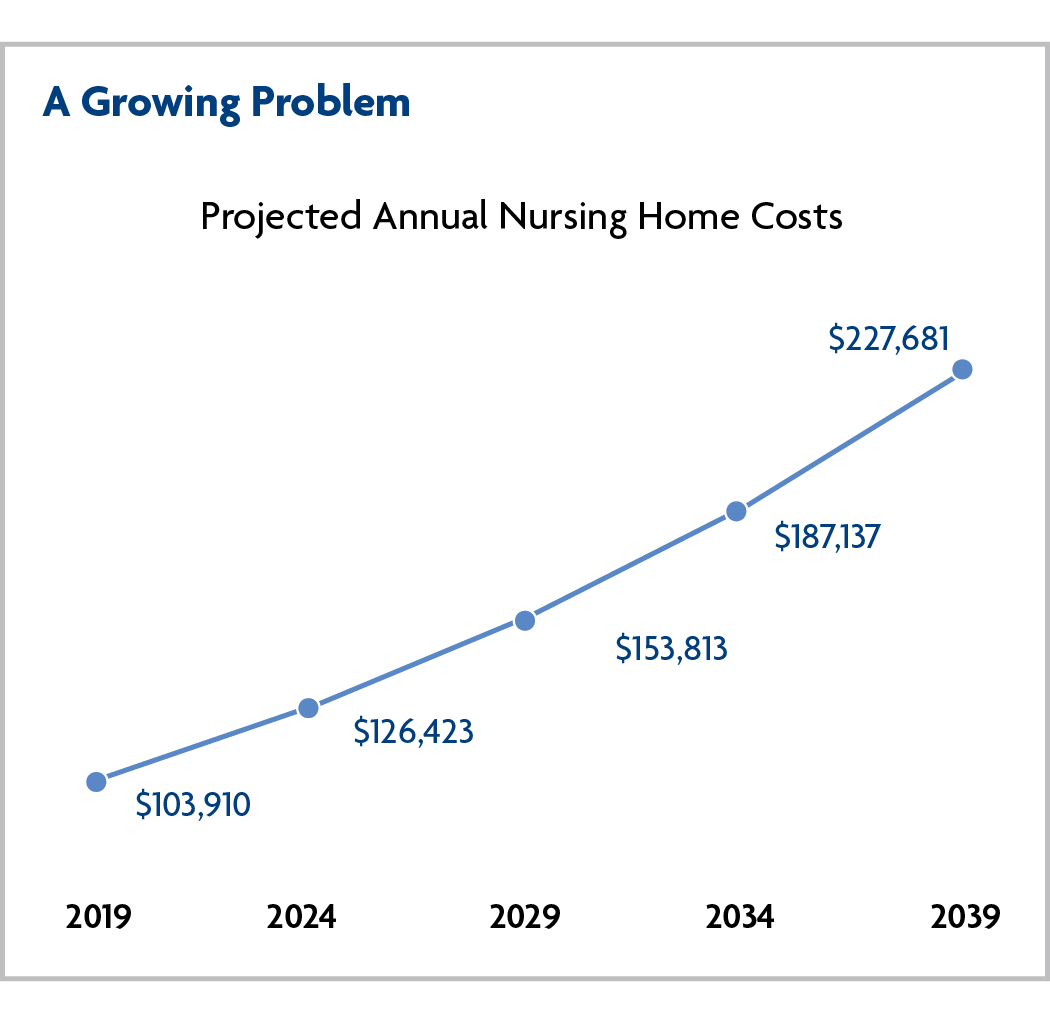

One of the greatest risks to a retirement nest egg is long-term care expenses. According to one survey, nearly seven out of ten Americans over age 65 will need long-term care services at some point.3 This is critical to bear in mind given that today, the average annual cost of a private room in a nursing home is more than $100,000.4

Moreover, in 20 years, nursing-home care would cost more than $227,000 a year, assuming a 4% annual increase in costs. Keep in mind, government assistance for these expenses is very limited, and few people qualify for it.

Without proper planning, long-term care expenses can wipe out a lifetime of savings, leaving no money to live on and nothing to leave behind for loved ones. Your financial professional can introduce you to insurance strategies that can help you safeguard your retirement assets and preserve wealth for your heirs.

Get Back On Track

If you find any of the aforementioned mistakes familiar, look to a professional for help. Ask your Financial Advisor about an Envision® investment plan. Using the Envision process will help you and your financial professional address critical questions, such as:

- Are you compromising your goals too much with your investment choices?

- Are you taking too much financial risk—or not enough?

- Do your goals need adjusting, or do you need to allow more time for achieving them?

- Will you have enough?

To begin the process, your Advisor will help you prioritize your goals. Using that and other information you will discuss with your financial professional the Envision process is designed to help you determine how well you are progressing toward achieving your goals.

For example, if you are 50 years old, have $750,000 in retirement savings, save $1,000 each month for retirement, invest primarily in stocks, and want to have $1.5 million at age 65, the Envision process will help you gauge whether you are on target to reach your objectives. In addition, the Envision process gives you and your Financial Advisor the flexibility to adjust your profile to account for changes in your life.

1. The amount of your withdrawal, combined with other income sources, will determine which tax bracket is applicable to your specific situation. Please consult your tax advisor.

2. This hypothetical illustration is based on Standard & Poors 500 Composite Index with dividends reinvested over the 20-year period of 2000 through 2019. This chart is for illustrative purposes only. Past performance is no guarantee of future results. This chart is not indicative of the performance of any specific investment. An index is not managed and is not available for direct investment. Returns and principal invested in stocks are not guaranteed. Holding a portfolio of securities for the long-term does not ensure a profitable outcome, and investing in securities involves risk of loss.

3. U.S. Department of Health and Human Services

4. ibid

Envision® is a registered service mark of Wells Fargo & Company and used under license

Start the Conversation

Where will your financial journey take you? A Financial Advisor helps you navigate the terrain, avoid pitfalls, and keep you on track to achieve your financial goals.